From Handshake to High-Growth: Decoding the Key Legal Documents in a Seed Round

Raising your first seed round is a landmark moment. But what about the mountain of paperwork? We're breaking down the essential legal documents, from term sheets to voting agreements, to help you navigate the process with confidence.

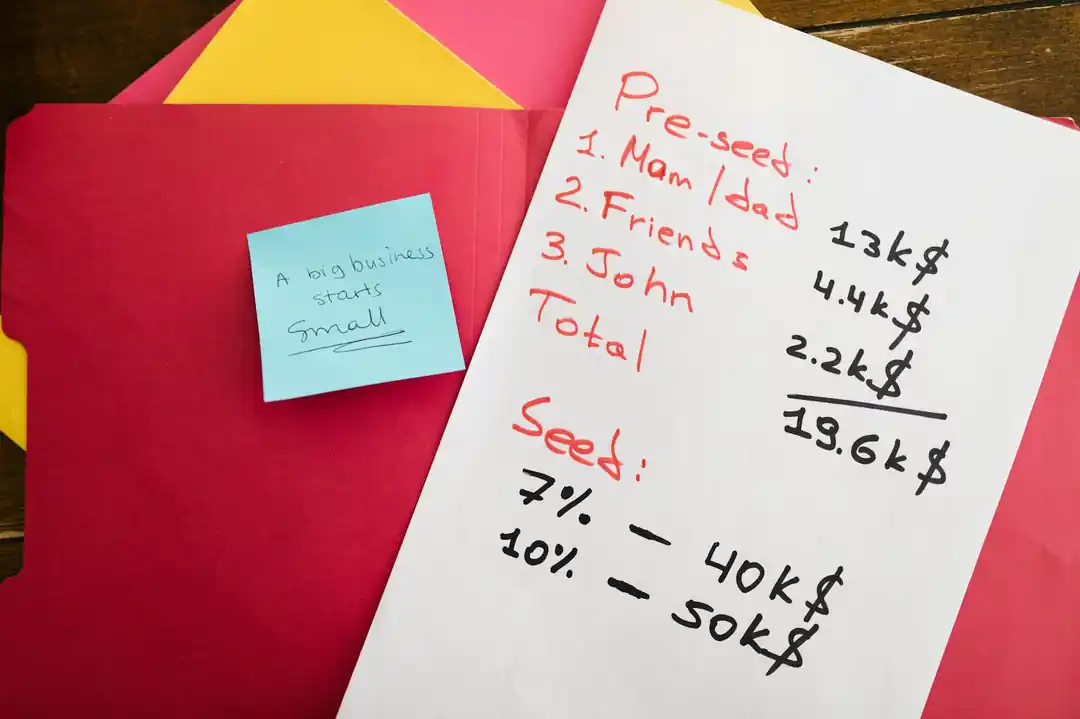

There’s a unique, electric feeling that comes with the decision to raise a seed funding round. It’s a potent mix of excitement, validation, and, if we’re being honest, a healthy dose of anxiety. Your idea, once just a concept sketched on a napkin or a late-night passion project, is about to be put to the test. You’re ready to bring on partners who will provide the capital to turn your vision into a reality. But as you step into this new arena, you’ll quickly find it’s governed by a language all its own—a language of legal documents that can feel both intimidating and impenetrable.

I remember the first time I saw a Term Sheet. It felt like trying to read a map in a foreign language. All I wanted to do was build a great product, but suddenly I was swimming in clauses about liquidation preferences, pro-rata rights, and vesting schedules. It’s a common experience for founders. We are builders and visionaries, not corporate lawyers. Yet, understanding these documents is not just a necessary evil; it's one of the most empowering things you can do for your company. These papers are the very architecture of your startup's future, defining your relationship with your investors and setting the rules of the road for years to come. So, let’s take a deep breath, grab a coffee, and demystify the key documents you'll encounter.

The Term Sheet: Your North Star

Before you get to the dense, legally-binding contracts, you’ll almost always start with a Term Sheet. Think of it as a blueprint for the investment—a summary of the proposed terms and conditions, usually presented in a 2-5 page document. While it’s mostly non-binding (except for specific clauses like confidentiality and exclusivity), its importance cannot be overstated. This is where you and your investors agree on the fundamental pillars of the deal before spending thousands of dollars on legal fees to draft the final agreements.

The Term Sheet is where the core negotiation happens. What’s the pre-money valuation of the company? How much are the investors putting in, and what percentage of the company will they own (the post-money valuation)? Are they receiving standard preferred stock? It also outlines control-related terms, such as who gets a seat on the board of directors and what decisions require investor approval. A well-negotiated Term Sheet creates a clear, shared understanding and prevents major disagreements down the line. It’s your roadmap for the entire financing process.

The Stock Purchase Agreement: Making It Official

Once the Term Sheet is signed and both parties are ready to move forward, the lawyers will draft the definitive, legally binding contracts. The centerpiece of this package is the Stock Purchase Agreement (SPA). This is the formal contract that facilitates the sale of stock from the company to the investors. It makes the deal real. The SPA obligates the investors to buy a specific number of shares at a set price and obligates the company to sell those shares.

The SPA is much more detailed than the Term Sheet. It includes extensive "Representations and Warranties," which are a series of statements the company makes about its business, financials, intellectual property, and legal standing. Essentially, you're assuring investors that the company is what you say it is. It also contains "Covenants," which are promises about how you will run the business, and "Conditions to Closing," which are prerequisites that must be met before the investment is finalized. It’s a hefty document, but it’s the engine of the entire transaction.

The Investors' Rights Agreement (IRA): Defining the Relationship

While the SPA governs the sale of stock, the Investors' Rights Agreement (IRA) dictates the ongoing relationship between the company and its investors after the deal is closed. This document grants specific rights to the investors to help them monitor their investment and participate in the company's future. It’s about information, access, and influence.

One of the most important provisions in an IRA is "Information Rights." This typically requires the company to provide investors with regular financial statements (e.g., quarterly and annual reports) so they can track performance. Another key right is the "Right to Participate" or "Pro-Rata Right," which allows investors to purchase their pro-rata share of any future stock offerings. This is a crucial anti-dilution protection, ensuring they can maintain their ownership percentage as the company grows and raises more capital. The IRA is where the long-term partnership dynamics are formally established.

The Voting Agreement & The Right of First Refusal/Co-Sale Agreement

These two agreements are all about control and alignment among the shareholders. The Voting Agreement binds certain stockholders (usually the founders and major investors) to vote their shares in a specific way on key matters, most notably the election of the board of directors. This ensures that the board composition agreed upon in the Term Sheet is maintained and provides stability in the company's governance.

The Right of First Refusal and Co-Sale Agreement (often shortened to ROFR/Co-Sale) governs how and when founders and other key shareholders can sell their stock. The "Right of First Refusal" gives the company and/or the investors the option to buy shares from a selling founder before they can be sold to an outside party. The "Co-Sale" (or "Tag-Along") right protects investors by allowing them to sell a portion of their own stock alongside the founder in a sale to a third party. Together, these provisions give investors a say in who joins the cap table and ensures that founders don't exit without them.

The Amended and Restated Certificate of Incorporation

Finally, to make the seed round official, your company will need to amend its Certificate of Incorporation (if you're a Delaware C-Corp, as most venture-backed startups are). This is the core legal document filed with the state that establishes the company's existence. For a financing, it's "amended and restated" to authorize the new class of "Preferred Stock" that the investors are purchasing.

This updated charter will define the specific rights, preferences, and privileges of the new Preferred Stock. This includes things like the "Liquidation Preference" (who gets paid first if the company is sold) and conversion rights (the right to convert preferred shares into common shares). It is the foundational document that legally creates the securities at the heart of the investment and enshrines the special rights of your new partners.

Navigating these documents is a rite of passage for every founder. It can be complex and, at times, tedious. But it is far from just "legal stuff." It's the process of building a strong, transparent, and durable foundation for your company. Don't be afraid to ask questions, lean on experienced legal counsel, and ensure you understand not just what you're signing, but why. This diligence will pay dividends for years to come, allowing you to focus on what you do best: building a business that changes the world.

You might also like

Your First National Park Trip: A Beginner's Guide to Unforgettable Adventure

Dreaming of visiting a US National Park but don't know where to start? I'm breaking down the essentials, from choosing a park to booking your spot, to make your first trip a soul-stirring success.

Beyond the Costume Box: How to Weave Vintage into Your Modern Wardrobe

Love the idea of vintage but scared of looking like you're in a period drama? Let's break down the simple, stylish ways to make timeless pieces feel perfectly at home in your 21st-century closet.

Into the Quiet: A Real-Talk Guide to Safety in Remote Locations

There's a magnetic pull to the world's untouched corners. But before you answer the call, let's talk about how to do it safely. This is about making your adventure memorable for all the right reasons.

When the Wild Stares Back: What to Do if You Encounter a Mountain Lion

It's a rare, heart-stopping moment. Knowing how to react when you meet a cougar on the trail can make all the difference. Here's how to stay safe.

Your Phone Is a Secret Genius: The AI Hiding in Plain Sight

Ever wonder how your phone got so smart? It’s not magic, it’s a quiet revolution in artificial intelligence happening right in your pocket.