A Beginner's Guide to Investing in International Stock Markets

Thinking about investing beyond your home country? Here's a simple guide to get you started with international stocks, ADRs, and ETFs.

If you're anything like me, the idea of investing can feel like a big enough mountain to climb on its own. You spend time learning the basics, understanding the lingo, and getting comfortable with the idea of putting your hard-earned money into the market. Most of us naturally start close to home, investing in the companies we know and see every day. And there’s nothing wrong with that. But what if I told you that by only looking at the U.S. market, you’re essentially exploring only one continent in a world full of them?

I used to think international investing was a game reserved for the pros—something that required special accounts, a deep understanding of global economics, and probably a few sleepless nights tracking markets in different time zones. Honestly, the complexity of it all was a major turn-off. But then I started to read about diversification and growth opportunities in other parts of the world, and my perspective began to shift. It turns out, dipping your toes into international waters is not nearly as complicated as it sounds, thanks to some clever financial tools that make it accessible for everyday investors.

Expanding your portfolio to include international stocks isn't just about chasing higher returns; it's about building a more resilient, balanced, and truly diversified financial future. It’s about giving your money a passport to explore growth wherever it might be happening. So, let's break down why you should consider looking abroad and how you can get started without needing a degree in international finance.

Why Your Portfolio Needs a Passport

Sticking to what you know feels safe. Investing in the big-name American companies you’ve trusted for years seems like a no-brainer. But this "home country bias" can inadvertently put all your financial eggs in one basket. The global economy is a complex, interconnected machine, and different countries' markets don't always move in perfect harmony. When the U.S. market is sluggish, another region might be booming. This is the core beauty of geographic diversification.

Think about it this way: some of the most innovative and fastest-growing companies in sectors like technology, renewable energy, and healthcare are based outside of the United States. By not investing internationally, you're missing out on the chance to be a part of their success stories. Furthermore, many emerging markets are growing at a much faster pace than developed economies. Tapping into these regions can offer a significant boost to your portfolio's long-term growth potential.

There's also the matter of currency risk. When you only hold investments in U.S. dollars, your entire portfolio's value is tied to the strength of that one currency. By holding assets in other currencies (like the Euro, Yen, or Swiss Franc), you create a natural hedge. If the dollar weakens, your international investments could actually be worth more when converted back, providing a valuable buffer for your overall wealth. It’s a savvy way to spread out risk and add another layer of stability.

The Easy Entry Points: ADRs and International ETFs

Okay, so the "why" is compelling. But what about the "how"? This is where it gets surprisingly simple. You don't need to open a foreign brokerage account or deal with complicated currency conversions. For most beginners, there are two fantastic tools that serve as your gateway to global markets: American Depositary Receipts (ADRs) and international Exchange-Traded Funds (ETFs).

An ADR is basically a certificate issued by a U.S. bank that represents a specific number of shares in a foreign company. You can buy and sell ADRs on U.S. stock exchanges, just like you would with shares of Apple or Microsoft. This allows you to invest in individual foreign companies—think giants like Toyota, Samsung, or Nestlé—with the same ease as domestic stocks. It’s a direct way to own a piece of a specific international company you believe in.

If you'd rather not pick individual stocks, international ETFs are your best bet. An ETF is a basket of stocks that you can buy or sell in a single transaction. An international ETF, therefore, holds stocks from many different companies across various countries. For example, you could buy an ETF that tracks the entire European market, or one that focuses specifically on emerging markets. This gives you instant diversification, spreading your investment across hundreds or even thousands of companies and reducing the risk of any single one performing poorly.

Navigating the Risks and Rewards

Of course, no investment is without risk, and it's important to go in with your eyes open. International investing comes with its own unique set of challenges. Political instability, changes in government regulations, or economic downturns in a specific country can all impact your investment. This is known as geopolitical risk, and it’s a factor that you don’t have to worry about as much when investing domestically.

Currency fluctuation is another key risk. If you invest in a European company and the Euro weakens against the U.S. dollar, your returns will be lower when you convert them back. The flip side is also true—a strengthening foreign currency can amplify your gains. It’s a double-edged sword that you should be aware of. This is why ETFs can be so helpful, as their broad diversification across many countries can help smooth out the currency impact from any single nation.

Before you jump in, take some time to do your research. Understand the expense ratios for ETFs (the small fee you pay for the fund's management) and be aware of any potential foreign taxes on dividends. Start small, perhaps by allocating just a small percentage of your portfolio to an international ETF. As you get more comfortable, you can gradually increase your allocation. The key is to start the journey and learn as you go.

Venturing into international markets is a powerful step toward building a truly global and resilient investment portfolio. It’s about broadening your horizons and recognizing that great opportunities aren't confined by borders. It might feel like a small step today, but it’s one that your future self will likely thank you for.

You might also like

Why Your Startup Needs a Corporate Credit Card—It's Not Just About Spending

In the chaotic world of a startup, managing finances can feel overwhelming. A corporate credit card isn't just another piece of plastic; it's a strategic tool for growth, control, and clarity.

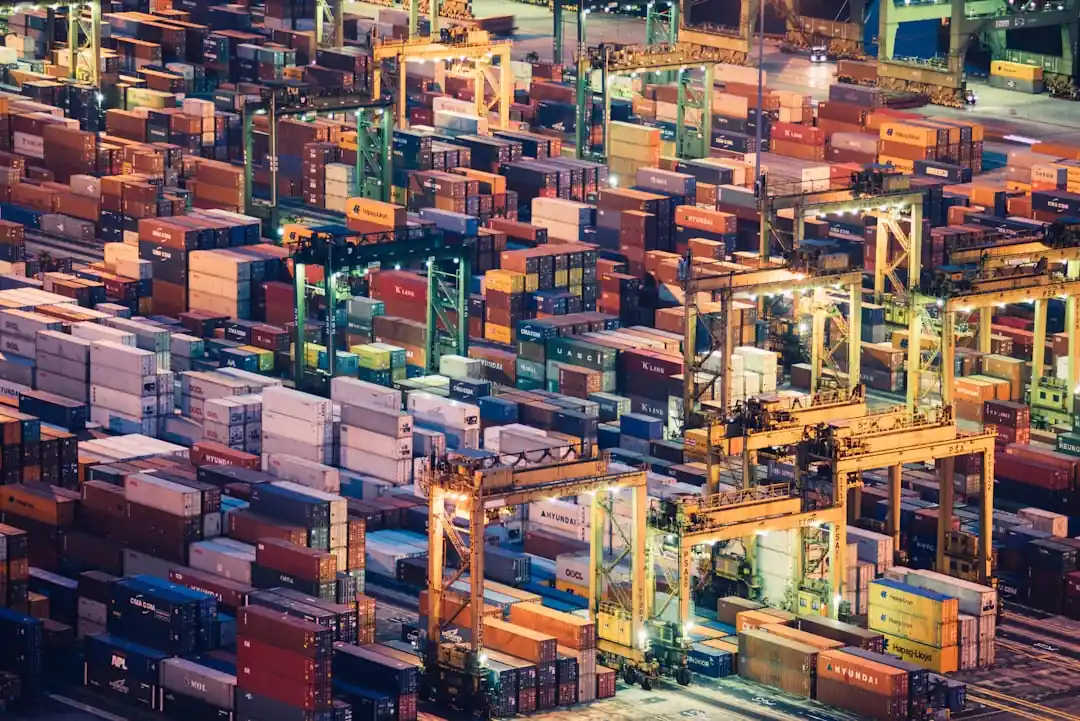

The Inflation Squeeze: How Rising Costs Are Reshaping Supply Chains

We all feel inflation at the checkout, but its real battleground is the global supply chain. Let's unpack how it's forcing businesses to rethink everything from shipping to strategy.

Gold's Golden Age: A Deep Dive into Historical Price Trends

From ancient treasure to modern safe-haven, gold's value tells a fascinating story of economic shifts and human behavior. Let's explore the historical trends that define this timeless asset.

Stop Guessing, Start Growing: How to Build a Weekly Meal Plan for Muscle Gain

Tired of working out hard but not seeing the muscle growth you want? The secret might be in your kitchen. Let's break down how to eat for real results.

A Yank's Guide to London's Storied Stones: How to Do History Right

Thinking of hopping the pond? Let's talk about how to truly experience London's most famous historical landmarks, from one American to another.